1. The United States loses the most cash to tax avoidance.

Information by Statista shows that the US loses about $188.8 billion every year in tax avoidance. China and Japan record yearly misfortunes of about $66.8 billion and $46.9 billion, individually. This means, even joined, they don’t come anyplace close to the American assessment evasion misfortunes. The expense of tax avoidance in India, Australia, and South Korea is $41.2 billion, $6.1 billion, and $1.1 billion, individually.

2. Tax avoidance costs the EU nations €823.5 billion per year.

In the period somewhere in the range of 2009 and 2021, charge evasion in the EU dropped by 12-16%. All things considered, the aggregate sum lost in neglected duties is staggering. Tax avoidance measurements by country show that Italy disapproved of assessment aversion expenses of €190.0 billion.

Germany and France follow with €125.1 billion and €117.9 billion lost to burden evasion. Different nations with outstanding assessment evasion sums were the UK (€87.5bn), Spain (€60bn), Poland (€34.6bn), and Belgium (€30.4).

Luxembourg, Estonia, and Malta, then again, recorded the most minimal tax avoidance sums. The cash lost to individuals and enterprises not paying assessments in these nations added up to €1.6 billion, €1.4 billion, and €0.9 billion, as per public and worldwide tax avoidance measurements.

3. Tax avoidance is answerable for about £5.3 billion of the British assessment hole.

In the financial year 2018, the UK saw an aggregate of 3,809 tax avoidance cases and 40,695 individuals called the tax avoidance hotline. In 2017-2018, the sum lost to not paying assessments added up to £37 billion. As per the UK charge misrepresentation measurements, tax avoidance has been on the ascent in the country. To be specific, in 2015-2016, there were just 2,972 tax avoidance cases recorded.

4. Almost 50% of British individuals wouldn’t report a relative for tax avoidance.

Around 43% said they wouldn’t report charge aversion by a relative. Around 35% of Brits said that they would report such wrongdoing and 18% didn’t have a clue how they would respond. Guys are more probable (47%) to conceal tax avoidance contrasted with females (40%).

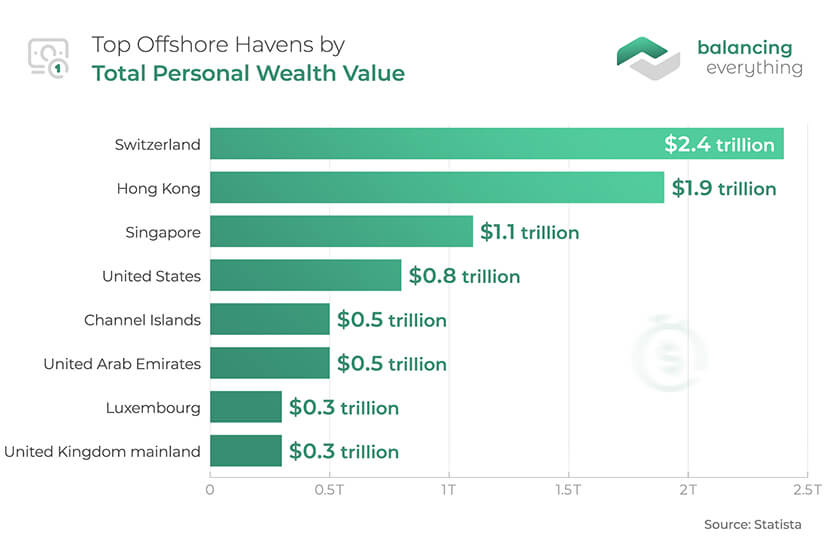

5. Switzerland, Hong Kong, and Singapore are the main seaward objections for individual riches.

Their private abundance sums from abroad in 2019 were $2.4 trillion, $1.9 trillion, and $1.1 trillion, as per tax avoidance measurements. It’s intriguing that the US is number 4 thinking that the greater part of its organizations holds billions seaward. Regardless, the country’s private abundance esteem from abroad was $800 billion every 2021. Other prominent notices here incorporate the Channel Islands ($500bn), the UAE ($500bn), and Luxembourg ($300bn).

6. Affluent people stow away between $21-$32 trillion of individual capital seaward.

Charge Justice’s corporate tax avoidance measurements propose that states overall lose about $189 billion every year because of such seaward close to home riches. Around 8% of family abundance overall is free from any and all harm in duty shelters. Around 75% of such capital is unrecorded. Benefit moving by global organizations in the interim expenses around $500 billion every year. Agricultural nations experience the ill effects of this.

7. In 2021, almost 500 cases taken care of by the US Sentencing Commission were related to charging misrepresentation.

Out of 76,538 detailed cases, an aggregate of 494 was charged misrepresentation offenses, as indicated by charge extortion insights. This means, under 1% (0.6%) of the instances of the Sentencing Commission was connected with this issue. There has been a positive pattern in the quantity of assessment misrepresentation offenses. In 2015, there was a sum of 660 cases, which was the largest number in the 2015-2021 period. Beginning around 2015, the quantity of assessment misrepresentation offenses has dropped by 25.2%.

8. More than 66% of Americans accept each resident should make good on charges.

Around 68% of members concur completely that it’s Americans’ liability to pay their portion to the country. 27% generally concur, while 3% and 2%, for the most part, differ and firmly conflict. More than 90% accept that every individual who avoids paying assessments ought to be considered responsible.

9. American organizations hold billions of US dollars seaward through auxiliaries in expense shelters.

US tax avoidance insights show that Apple drove the way with its $252.3 billion held seaward. No other organization drew close to this sum, however, Microsoft was the main undertaking with more than $100 billion abroad. Specifically, the tech goliath had $127.9 billion external US soil. The main five rundowns were gathered together with Cisco ($67.5bn), Oracle ($54.4bn), and Google’s proprietor, Alphabet ($52.2bn).

10. Twenty Fortune 500 ‘non-unveiling’ organizations held more than $1 trillion in unrepatriated pay.

Corporate tax avoidance insights show that an aggregate of $1.07 billion in unrepatriated pay stayed external the United States because of organizations keeping their cash seaward. Here, Pfizer drove the way with its $197 billion, while General Electric followed with 82 billion. Worldwide Business Machines was one more organization with a huge unrepatriated pay of $71.40 billion. The rundown of top 20 organizations with significant unrepatriated pay included well-known brands like Cisco Systems, Johnson and Johnson, and Coca-Cola.

11. Underreporting is the most well-known kind of tax avoidance in the US.

Tax avoidance insights show that around 84% of the cases have a place in this class, and the nation loses about $386 billion due to underreporting. Here, people make the most offenses (68%), while corporate personal duty (11%) and work charge (21%) underreporting represent the leftover misfortunes.

Underpayment and non-documenting are the two other normal sorts of duty evasion, yet undeniably less noticeable than underreporting. These two address just 9% and 7%, separately, of tax avoidance in the USA, as per charge extortion measurements. The States lose about $39 billion to underpayment and $32 billion to non-documenting.

12. The expense hole because of individual pay underreporting in the US is more than $250 billion.

An aggregate of $264 billion was lost due to underreporting by Americans. The biggest portion of $125 billion comes from business pay and $64 billion from non-business income. Credits and derivations contribute misfortunes of about $40 billion and $18 billion, individually.

13. While the expense whole sum in the US develops the consistency rate drops.

US tax avoidance measurements uncover that in 2006 the gross assessment hole was $450 billion. In the period somewhere in the range of 2008 and 2010, it expanded by $8 billion to $458 billion. A comparative pattern was seen among the net expense hole, which went from $385 billion to $406 billion. The net consistency rate, conversely, dropped from 85.5% to 83.7%. These figures show that the portion of Americans who dodged paying expenses was gradually expanding.

14. Organizations underreport about $41 billion per year.

This figure addresses around 9% of the complete duty hole in the US, as indicated by IRS tax avoidance measurements. Enormous partnerships whose resources are esteemed at $10 at least million underreport about $28 billion every year. Little companies esteemed under $10 million underreport about $13 billion, per the. Moving our emphasis on the underpayment hole, companies neglect to pay about $3 billion in corporate annual expense.

15. More than 66% of the wrongdoers are men.

Tax avoidance insights show that in 2021, 68.1% of the wrongdoers were men. White Americans submitted the most expense extortion cases, i.e., 48.2%. African Americans, Hispanics, and individuals from different races were liable for 32.6%, 13.3%, and 5.9% of expense extortion in the States. Most wrongdoers (93.1%) were US residents, and their normal age was 50 years. Curiously, 80.2% of the guilty parties had no or minimal earlier criminal history.