An Overview of Hard Money Loans

Prior to examining inquiries to pose too hard cash banks, I want to give an overall outline of how hard cash loaning functions.

Hard cash exists as an option in contrast to customary financing (for example your standard, 30-year home loan). Also, hard doesn’t mean testing. Rather, it implies that these loan specialists exclusively fret about the “hard” resource, that is, the actual property.

As expressed, conventional moneylenders require the least guidelines with the borrower’s “delicate” resources. Hard cash loan specialists don’t fret about this. These loan specialists check out a property and ask, what will this property become? They base their choice to loan on the projected later fix esteem (ARV) of a property.

This framework gives land financial backers two key benefits. In the first place, you can get a hard cash advance regardless of whether you have an incredible financial assessment (at the same time, loan specialists probably won’t work with you on the off chance that you have insolvencies or decisions in your record as a consumer). Second, you can utilize hard cash advances for bothered properties, making them ideal for fix and flip and BRRR financial backers.

Conventional banks need to affirm that, whenever dispossessed upon, a property will cover the credit balance now. Hard cash moneylenders expect more danger. The loan depends on what they accept the property will be worth later on. While each hard cash bank offers various terms, at Do Hard Money we’ll loan up to 70% of a property’s ARV. All things considered, assuming a borrower neglects to effectively rebuild a property, hard cash banks need to recover their exceptional credit offset with a troubled property deal. Also, selling property in maintenance probably won’t take care of the exceptional credit balance, as the advance depended on what the property would turn into.

Because of this expanded danger and the more limited-term nature of hard cash advances, they have higher rates than conventional home loans. Contingent upon your contributing history and the nature of the arrangement, you can expect a loan fee from 7.99% to more than 15%. In any case, financial backers can likewise close these advances amazingly rapidly. Most conventional home loans commonly expect 30 to 45 days to close. You can close a hard cash advance in under seven days.

Loan specialist Criteria

I addressed it above, yet hard cash moneylenders possibly have a couple of standards in regards to the individual foundation while exploring a financial backer’s advance application:

Not in assortments: If you have an exceptional judgment against you and are in the assortments interaction, most hard cash banks won’t give you a credit. These people absolutely present an over-the-top danger of reimbursement.

No liquidations: If you have insolvency on your record, you likewise logically will not fit the bill for a hard cash credit – for the above reasons.

No significant criminal foundation: Hard cash banks will totally run a criminal personal investigation on financial backers. Minor misdeeds can be deferred dependent upon the situation, contingent upon the idea of the wrongdoing. Notwithstanding, assuming you have a crime on your record, it’s exceptionally impossible that a bank will support your hard cash advance.

Expecting you clear the above obstacles, hard cash credit endorsement truly boils down to two things. To begin with, what credit-to-esteem (LTV) terms will a moneylender offer. That is the manner by which huge of an advance will they give, in light of a property’s ARV. This leads straightforwardly into the second thing hard cash loan specialists intently examine: a property’s ARV.

ARV Appraisals

By and by, hard cash banks base their advances on what a property will be worth. However, how would you esteem something that doesn’t as yet exist? To do this, hard cash moneylenders require an ARV evaluation preceding giving an advance.

With a standard evaluation, appraisers search for ongoing deals comps for the property in its present status. ARV examinations likewise incorporate “with no guarantees” comps and decide a “with no guarantees” esteem. Be that as it may, they likewise represent the arranged redesign and what the house will resemble later they’re finished. All the more definitively, an appraiser will break down your submitted worker-for-hire offers for work, observe properties that have had comparable degrees of work, and decide an ARV dependent on those comps.

While more costly than standard evaluations, these ARV examinations give hard cash loan specialists the data they need to decide the amount they’ll loan.

A Hard Money Lending Example

While the above gives an outline of what hard cash banks do, it assists with seeing a substantial model. Expect you to track down an incredible arrangement on a troubled property It’s selling for $120k, and you feel that with a $100k remodel and deal financial plan, you’ll have the option to sell it for $310k. With somewhat back-of-napkin math, that is a great $90k benefit.

However, as you don’t have $220k cash for the buy and fixes, you apply for a hard cash credit to take care of these expenses. While you want to get $310k for the property later in the recovery period, the hard cash loan specialist will require confirmations from an ARV evaluation. You present all of your worker-for-hire offers, and the expert appraiser decides ARV to be $300k – $10k not exactly your underlying evaluation.

With a $300k ARV, the hard cash moneylender (expecting 70% ARV credit), will loan you $210k ($300k ARV times 70%). In any case, your arrangement spending plan sums $220k. This implies that to push ahead with the arrangement, you’ll have to place in $10k money to cover the contrast between the $210k hard cash credit and you’re all-out financial plan.

This is typical with hard cash advances. That is, you’ll commonly have to observe assets in the abundance of your hard cash credit. To be honest, it’s incredibly hard to track down the kind of magnificent arrangement that a hard cash credit will 100% cover. This reality implies that most financial backers have other financing strategies to meet their spending plan needs over a hard cash credit. While not a complete rundown, financial backers can do the accompanying to overcome any barrier between a hard cash advance and arrangement spending plan:

- Put their own money into the arrangement.

- Utilize a business credit extension.

- Utilize a home value credit extension.

- Utilize a home value advance.

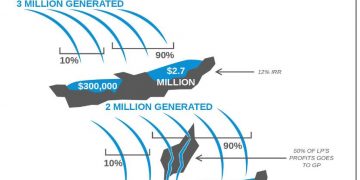

- Welcome on restricted accomplices.

- Inquiries to Pose to Hard Money Lenders

Question 1: What is the greatest LTV you will offer?

Contingent upon how much money you’re willing to contribute, this will represent the deciding moment of an arrangement. What’s more, from a profit from a venture point of view, the more influence you can use in an arrangement, the bigger your profit from contributed capital. (NOTE: Increased influence additionally expands hazard, which is the reason we harp on the significance of appropriately dissecting bargains prior to submitting).

As expressed above, Do Hard Money offers terms of 70% LTV. On the other hand, say a bank offers you 65% LTV terms all things considered. On a property with a $300k ARV, that 5% distinction means a $15k more modest credit – possibly the contrast between the hard cash advance totally taking care of your expenses or expecting to get extra hole financing.

Question 2: Do you base LTV on a price tag or ARV?

Notwithstanding the genuine LTV, you really want to find out if they base these estimations on ARV or price tag. While most hard cash moneylenders base their LTV estimations on ARV, not all do. Also, this distinction can prompt a huge number of dollars in decreases in hard cash advances.

For instance, say you buy an upset property for $100k, figure you can put $50k into it, and afterward sell it for $200k. On the off chance that the appraiser affirms this $200k ARV, Do Hard Money would offer a $140k advance. On the other hand, say a moneylender offers 80% LTV – apparently high – yet puts together it with respect to the price tag. This bank would endorse a hard cash credit of $80k, which means you’d need to one or the other A) put your very own lot cash into the arrangement, or B) secure hole financing to cover the distinction.

Question 3: What is the greatest credit sum you will offer?

This relates straightforwardly to the above questions. For example, a hard cash moneylender might offer 75% LTV credits – a genuinely exclusive expectation. From the get-go, this appears to be an extraordinary chance, as you can back a bigger piece of an arrangement than a 60% or 70% bank will permit. However, assuming that equivalent bank covers the greatest advance sums at $150k, you’ve essentially restricted your pool of accessible arrangements.

Question 4: Do you finance a specific kind of property?

Numerous hard cash moneylenders center their loaning around a specific property type, regularly something with which they have a great deal of involvement. I committed this error as another financial backer. I observed what I thought were incredible arrangements, yet I was unable to observe a moneylender intrigued by those properties. In that capacity, I took in the most difficult way possible – it’s smarter to discover what kind of properties a loan specialist will back before you go out searching for bargains.

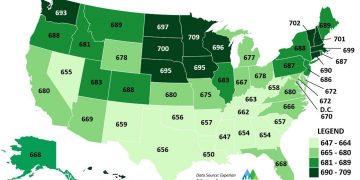

Question 5: Do you just loan for properties in specific geographic regions?

Likewise, with conventional banks, numerous hard cash loan specialists center their loaning exercises in specific business sectors. More modest moneylenders may just loan for properties in and around specific urban areas, essentially restricting the pool of accessible properties. In any case, these more modest loan specialists may likewise enjoy a benefit in market commonality and capacity to offer nearby help.

Then, a few moneylenders offer advances for bigger districts or across the country. These extended loaning markets open up the pool for likely properties. In any case, it might likewise imply that a specific hard cash bank has less comprehension of a specific market. Luckily, however, most hard cash loan specialists that work broadly are sufficiently huge to offer huge regulatory help for their borrowers, regardless of whether they have a “boots on the ground” presence in a given market.

Question 6: How would you deal with credit reimbursements?

This is greatly significant. A few moneylenders require month-to-month revenue (or head and premium installments) later a specific measure of time. This can genuinely challenge your income and upset your arrangement’s spending plan. On the other hand, at Do Hard Money, we gather all revenue front and center, implying that financial backers pay everything off simultaneously toward the part of a bargain, which improves the planning and income process.

Question 7: How would you deal with credit draws?

With a conventional home loan, you get a solitary singular amount to buy a home. Banks can acknowledge this danger because of the nature of the property filling in as a guarantee. As such, they’re giving you credits on a finished, prepared-to-involve home needing no or barely any fixes. That way, assuming you quit paying your home loan, they can abandon the property, sell it, and recover the whole credit balance.

Hard cash loan specialists, then again, utilize bothered properties as security. What’s more, these moneylenders base their credits on what a property will turn into. Say, for example, you meet all requirements for a $210k hard cash advance depending on a $300k ARV. That property isn’t right now worth $300k – or, probable, even $210k. Subsequently, assuming a hard cash loan specialist expected to abandon the property, they wouldn’t recover their whole $210k surplus.

To represent this reality, hard cash moneylenders issue advances in increases – known as draws. For instance, you might accept you’re first attracted to buy the home. Then, at that point, in the wake of finishing a specific level of the fixes, you might get a subsequent draw. At the point when the work is done, you’ll accept your last draw.

Each hard cash moneylender structures these draw demands and the related achievements in an unexpected way. These techniques will altogether influence your income during the remodel period. Thus, it’s important that you comprehend a loan specialist’s draw strategies and prerequisites.

Question 8: What support, assuming any, do you give to your borrowers?

Then, land financial backers ought to ask what kind of help a hard cash bank will give past giving the credit. At the end of the day, will a given moneylender assist with directing you through the house flip interaction, or just issue the credit and hang tight for you to reimburse that advance?

At Do Hard Money, we accomplish more than essentially issue credits. Also, on the grounds that I accept so unequivocally in our model, I will improperly plug this help now.

We comprehend that most new financial backers need some assistance and direction during their first arrangement. We offer this help. Our group will interface you up with project administrators and guides to help you through the whole fix and flip cycle. As far as we might be concerned, we consider this to be a mutual benefit:

Win 1: We help new financial backers by giving them admittance to hard cash credits for which they probably wouldn’t in any case qualify.

Win 2: By aiding new financial backers, we help ourselves. We need you to succeed, as this brings down our danger as loan specialists. Furthermore, helping you en route lays out the groundwork for you in that first arrangement.

In view of this way of thinking, we’ll guide and coach new financial backers through the significant stages of the fix and flip cycle.

Question 9: Do you have any total assets or liquidity prerequisites?

One of the essential benefits to utilizing hard cash loan specialists is that you for the most part needn’t bother with a huge load of money to finish an arrangement. Rather than auditing your own monetary wellbeing, hard cash moneylenders endorse or keep advances dependent on the quality from getting the actual arrangement.

Sadly, however, a few moneylenders in all actuality do have total assets or liquidity prerequisites. For instance, a bank may not support hard cash credits except if the borrower is valued at $500k. Or on the other hand, another may say that you really want to have essentially $100k in real money or money reciprocals available. While these are simply model figures, the significant important point is that you want to inquire as to whether a hard cash bank forces this kind of prerequisite.

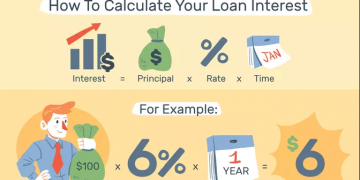

Question 10: What are your start charges and loan fees?

Hard cash moneylenders bring in cash through the beginning charges and credit revenue. Prior to marking a credit application, you’ll need to affirm precisely how a given loan specialist structures them both:

Start expenses: These are the charges a hard cash bank charges to definitely begin, or set up, an advance. Advance beginnings set aside time and managerial exertion, and moneylenders require to pay for this work. Contingent upon the bank, these expenses can be charged as 1) a level charge, 2) a level of the advance sum, or 3) a blend of these choices.

Credit revenue: This is the thing that moneylenders charge for allowing borrowers to utilize their cash. In theoretical terms, the premium is the manner by which banks are made up for the danger they’re taking by loaning cash. What’s more, hard cash banks expect more serious danger than customary home loan moneylenders, in light of the fact that these credits are gotten by properties that actually should be remodeled. Assuming that a borrower defaults before finishing the recovery, private and hard cash loan specialists need to abandon a to some extent rehabbed property. Because of this expanded danger, these moneylenders charge higher loan costs than conventional banks.

Question 11: Do you charge a credit application expense?

Connected with the above expenses, a few banks will charge you a hard cash advance application expense. I strongly suggest that you keep away from such a moneylender charge. Sure and set up banks don’t have to bother possible borrowers with advance application expenses, understanding that they will rather bring in cash through fruitful arrangements. All things being equal, banks that charge such expenses are regularly temperamental, best-case scenario, and absolutely deceitful even from a pessimistic standpoint.